IRS 2553 2017-2026 free printable template

Instructions and Help about IRS 2553

How to edit IRS 2553

How to fill out IRS 2553

Latest updates to IRS 2553

All You Need to Know About IRS 2553

What is IRS 2553?

Who needs the form?

Components of the form

How many copies of the form should I complete?

What information do you need when you file the form?

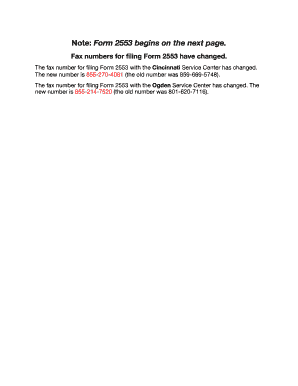

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

Due date

What payments and purchases are reported?

What are the penalties for not issuing the form?

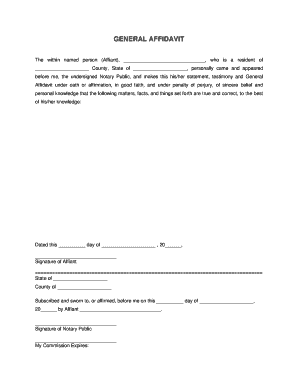

Is the form accompanied by other forms?

FAQ about IRS 2553

What steps should I take if I made a mistake on my IRS 2553 form?

If you realize you've made an error on your IRS 2553, you can submit a corrected form. Make sure to use the latest version and mark it as an amended filing. It's advisable to include an explanation of the changes made to avoid confusion during processing.

How can I track the status of my IRS 2553 form after submission?

To track your IRS 2553 status, you can contact the IRS directly or check via their online systems. Keep in mind that it may take several weeks for processing, and if you used e-filing, note any common rejection codes to resolve potential issues swiftly.

What are the common errors to avoid when filing the IRS 2553?

When completing the IRS 2553, ensure all required fields are filled accurately, including the selection of your tax year. Double-check signatures and ensure all supporting documents are included. These steps help prevent delays or rejections of your submission.

What should I do if I receive a notice from the IRS regarding my submitted form?

If you receive a notice from the IRS concerning your IRS 2553, it's crucial to read it carefully for specific instructions. You may need to gather documentation or provide additional information. Respond promptly to avoid any compliance issues.

Can I e-file the IRS 2553, and what technical requirements are needed?

Yes, you can e-file the IRS 2553 through certified tax software. Ensure that your chosen software is compatible with the IRS systems, and keep your browser up to date to prevent technical issues during submission.

See what our users say