IRS 2553 2017-2025 free printable template

Show details

To make the election you must complete Form 8716 Election To Have a Tax Year Other Than a Required Tax Year and either attach it to Form 2553 or file it separately. In order for the trust named above to be a QSST and thus a qualifying shareholder of the S corporation for which this Form 2553 is filed I hereby make the election under section 1361 d 2. R.B. 1046. Attach to Form 2553 a statement describing the relevant facts and circumstances and if applicable the gross receipts from sales and...

pdfFiller is not affiliated with IRS

IRS Form 2553: instructions and help on filling out and submitting

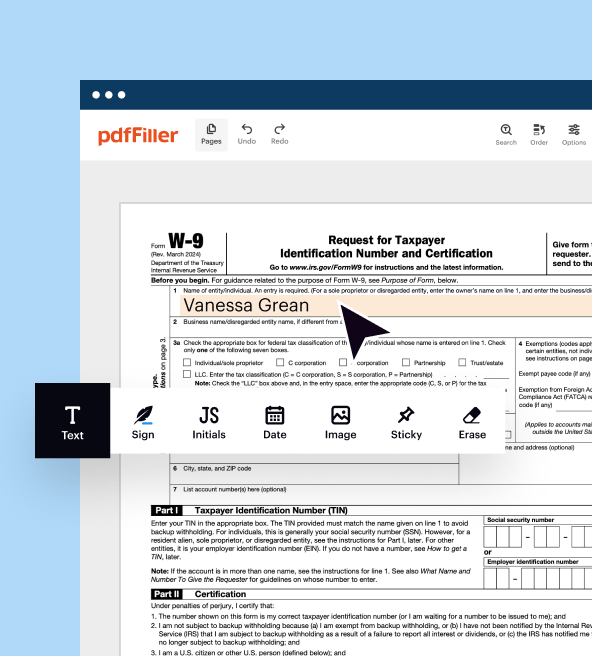

How to edit 2553 form online with pdfFiller

IRS form 2553 2025 online filing

Video instructions and help with filling out and completing 2553 form

IRS Form 2553: instructions and help on filling out and submitting

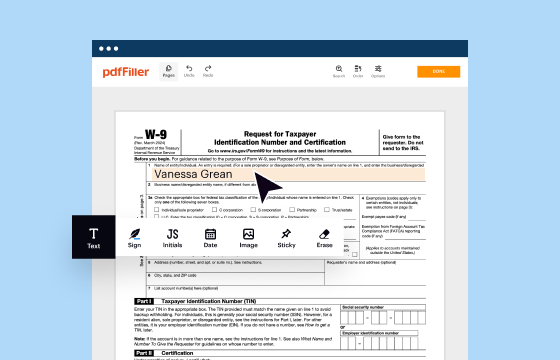

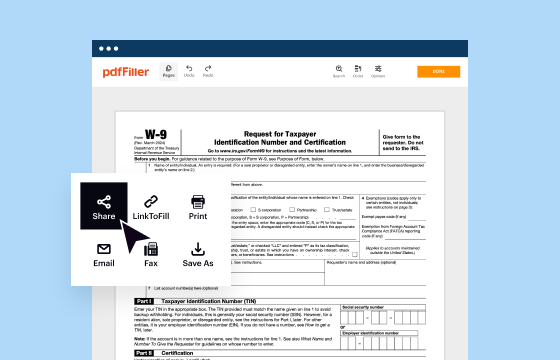

Completing an IRS Form 2553 fillable doesn't have to be complicated or time-consuming. With our simple and user-friendly online platform, you can easily edit, fill out, and submit your Form 2553 in just a few clicks.

How to edit 2553 form online with pdfFiller

01

Go to Get Form at the top of the page to open the IRS Form 2553 fillable PDF.

02

Fill out the required fillable fields with our simple editor.

03

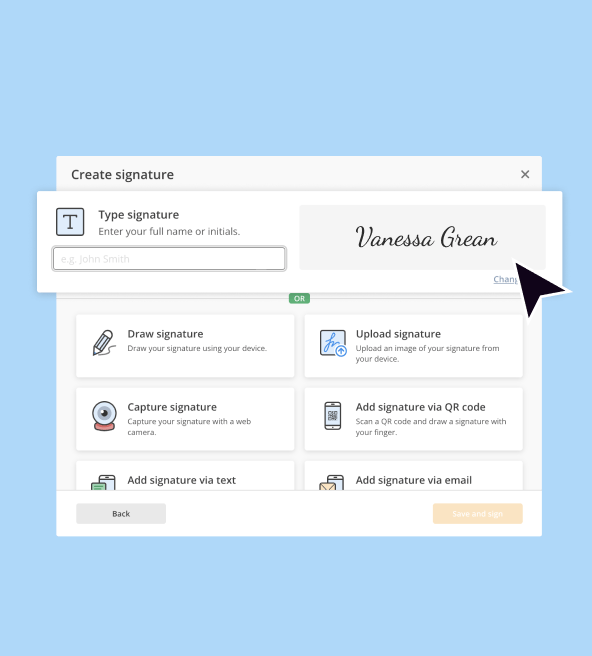

Protect your completed document with watermarks if needed.

04

eSign your document by drawing, texting or uploading your signature.

05

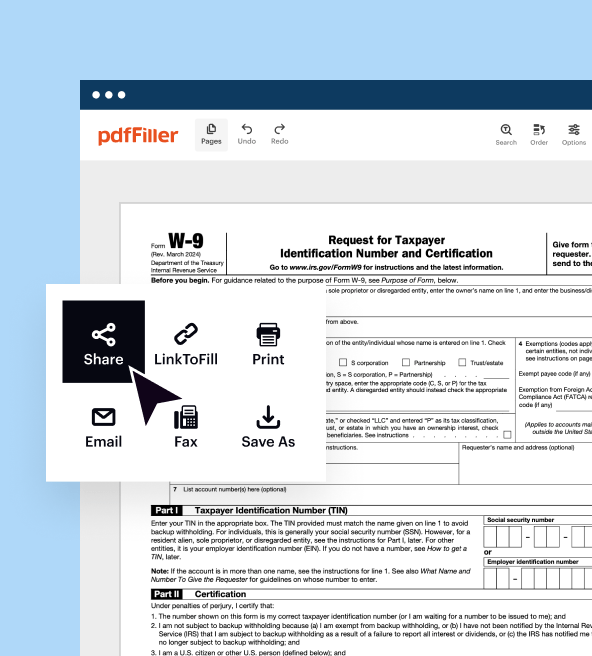

Save all the changes in the completed file by clicking Done.

06

Create a pdfFiller account to perform the further chosen action.

07

Sign up for pdfFiller’s free 30-day trial. Then go to your form 2553, download, or print it.

08

Use the Submit to IRS option to send your PDF file to IRS Service Center corresponding to the principal business location.

09

Use our Mail by USPS option to send your report by mail right from the editor.

IRS form 2553 2025 online filing

Here’s some basic information on how to complete Form 2553.

Step 1: Download Form 2553 from the IRS website. After obtaining your form 2553, fill in online the following parts.

Step 2: Complete Part I – Election Information according to the fields and the columns’ names.

Step 3: Complete Part II – Tax Year Information (if applicable).

Step 4: Complete Part III – Qualified Subchapter S Trust (QSST) Election (if applicable).

Step 5: Review Part IV – Late Corporate Classification Election (This part comes into play if you’re filing a late election).

Step 6: Sign and date the IRS Form 2553.

Step 7: File Form 2553 via mail or fax, keeping up with the deadline.

Step 8: Await the confirmation from IRS

For more detailed guidance on each field, refer directly to the instructions available on the IRS website.

Video instructions and help with filling out and completing 2553 form

Show more

Show less

Updates and changes to the IRS Form 2553

Updates and changes to the IRS Form 2553

Here is a summarized list of updates to the Form 2553 instructions as revised in December 2020:

01

Eligibility Criteria:

Must be a domestic corporation or entity eligible to be elected as a corporation.

Cannot exceed 100 shareholders.

Only individuals, estates, exempt organizations, or certain trusts can be shareholders.

Nonresident aliens cannot be shareholders.

02

Election Filing Deadlines:

One must file form 2553 at most 2 months and 15 days after the beginning of the tax year.

Examples regarding filing timelines were provided for both new and existing corporations.

03

Late Election Relief:

Provides criteria for requesting relief due to missing the filing deadline.

Requires explanation of reasonable cause and shareholder consent.

Relief requests must be made within 3 years and 75 days of the effective date.

04

Filing Procedures:

IRS Form 2553 can be sent via designated private delivery services.

Instructions on where to file based on the principal business location.

05

IRS Notification:

Entities will be notified of election acceptance or rejection within 60 days.

Additional 90 days if specific tax year requests are made.

06

Qualified Subchapter S Subsidiary Election:

Guidance on treating a wholly owned subsidiary as part of the parent S corporation.

07

Shareholder Consent and Signatures:

Detailed rules on who must sign the IRS form 2553, including community property rules.

All consents to be signed in specified columns or attached statements.

Show more

Show less

General facts you should know about the IRS Form 2553

What is Form 2553?

Who needs Form 2553?

When is Form 2553 due to the IRS?

Is IRS Form 2553 accompanied by other forms?

Where do I send Form 2553?

General facts you should know about the IRS Form 2553

Here you can find the general and specific facts about the IRS Form 2553, also known as the "Election by a Small Business Corporation" form.

What is Form 2553?

Shortly, IRS form 2553 is an S corp election form: a corporation uses it or eligible entity to elect to be treated as an S corporation under Section 1362(a) of the Internal Revenue Code. This election allows income to be taxed to shareholders rather than the corporation itself, although the S corporation may still owe taxes on certain income. An entity that is eligible and meets certain conditions can use this form to avoid filing Form 8832 for entity classification.

Who needs Form 2553?

Every eligible domestic corporation or entity that wants to elect S corporation status needs to file file Form 2553. To qualify, the entity must have no more than 100 shareholders, consist of certain types of shareholders like individuals and estates, and have only one class of stock. Additionally, it must not be an ineligible type of corporation, such as a bank using the reserve method for bad debts or an insurance company under certain subchapter L tax codes.

When is Form 2553 due to the IRS?

For the election to take effect for a particular tax year, the document must be filed no more than two months and 15 days after the beginning of the tax year or anytime during the preceding tax year. For example, if the tax year begins on January 1, 2025, Form 2553 for 2024 should be filed by March 15, 2025.

Is IRS Form 2553 accompanied by other forms?

Form 1120-S may accompany it if a late election is being made and all subsequent forms 1120-S have been filed. Additionally, if the corporation requires a different tax year, Form 1128 might need to be filed. Certain election exceptions, such as becoming a Qualified Subchapter S Subsidiary (QSub), require Form 8869.

Where do I send Form 2553?

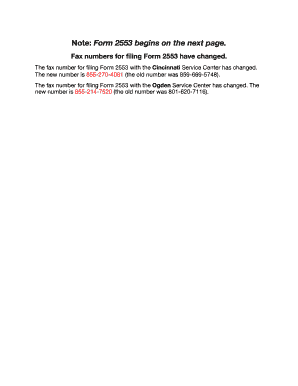

The mailing address 2553 form is available on the IRS website. You should send the report to the IRS Service Center corresponding to the principal business location. For entities in the eastern half of the United States, including states like New York and Georgia, the document is sent to the IRS in Kansas City, MO. For those in the western half, including California and Texas, it goes to Ogden, UT. The specific addresses and fax numbers are provided on the IRS website or in the instructions.

Show more

Show less

FAQ

What are the key shareholder requirements to qualify as an S corporation?

An S corporation must have no more than 100 shareholders, who are individuals, estates, certain exempt organizations, or certain trusts. Nonresident aliens cannot be shareholders, and there must be only one class of stock.

What should a corporation do if it fails to file Form 2553 on time?

If you didn’t file Form 2553 on time, the corporation can seek relief for a late election by demonstrating reasonable cause for the delay and showing diligent actions to remedy the situation. This includes fulfilling certain criteria outlined in Rev. Proc. 2013-30.

What happens if the IRS accepts or rejects my Form 2553 election?

You will receive a notification of acceptance or rejection from the IRS within approximately 60 days. If box Q1 is checked, it may take an additional 90 days. If you do not receive a response, follow up with the IRS.

Can an S corporation have multiple classes of stock?

No, an S corporation can only have one class of stock. However, differences in voting rights are permissible and do not constitute a second class of stock. Restrictions on transferability also do not create a second class of stock.

What is the role of the shareholders' consent in the Form 2553 election process?

Every shareholder at the time of the election must consent to the S corporation election by signing the Shareholder's Consent Statement in Part I, column K, or a similar attached document. This ensures that all shareholders are aware and in agreement with the decision to elect S corporation status.

What tax years can an S corporation select when filing Form 2553?

An S corporation may select a tax year ending on December 31, a natural business year, an ownership tax year, a tax year elected under section 444, or a 52-53-week tax year ending concerning any of these.

What is a Qualified Subchapter S Subsidiary (QSub), and how is it related to the IRS Form 2553?

A Qualified Subchapter S Subsidiary (QSub) is a wholly owned subsidiary of an S corporation that can be treated as part of the parent S corporation. The election is made on Form 8869, not Form 2553. It's important for S corporations to carefully consider whether converting a subsidiary into a QSub is beneficial.

What is the procedure for changing the tax year when electing S corporation status?

The corporation must file Form 2553 with the new tax year information and, if necessary, file Form 1128 if changing the tax year unrelated to the first tax year as an S corporation. Approval from the IRS may be required under specific provisions.

How do I file Form 2553 with the IRS?

For filling out the form, please follow the IRS Form 2553 instructions above. Submit the original file to the appropriate IRS office based on the corporation's primary place of business. It can be mailed or faxed, depending on the jurisdiction, and must be kept in corporate records.

What happens if the S corporation election is terminated or revoked?

Once terminated or revoked, IRS consent is generally required to make another election before the 5th tax year after the first year in which the termination or revocation took effect. In addition, the S corporation must file Form 1120S for all affected years and may be subject to additional taxes.

Fill out form 2553